enhancing the independent and objective oversightassessment of risk by our board of directors; and

providing an independent spokesman for our company.

Although the independentroles of chairman and chief executive officer are currently separate, our corporate governance and nominating committee and board of directors have an active voice in the governance of the Company.

Policy Governing Security Holder Communications with the Board of Directors

Security holders who wish to communicate directly with the Board, the independent directors of the Board or any individual member of the Board may do so by sending such communication by certified mail addressed to the Chairman of the Board, the entire Board, to the independent directors as a group or to the individual director or directors, in each case, c/o Secretary, Cue Biopharma, Inc., 21 Erie Street, Cambridge, Massachusetts 02139. The Secretary reviews any such security holder communication and forwards relevant communications to the addressee.

Employee, Officer and Director Hedging

Pursuant to the Company’s Insider Trading Policy, directors, officers, employees and and/or consultants of the Company and its affiliates, as well as any immediate family members sharing the household of any of the foregoing are prohibited from engaging in transactions in publicly traded options, such as puts, calls and other derivative securities, relating to the Company. This prohibition also extends to various forms of hedging transactions or monetization transactions, such aszero-cost collars and forward sale contracts, as they involve the establishment of a short position in the Company’s securities.

Policies Regarding Director Nominations

The Board has delegated to its Corporate Governance and Nominating Committee responsibilitybelieve it is appropriate for establishing membership criteria for the Board, identifying individuals qualified to become directors consistent with such criteria and recommending the director nominees.

The Corporate Governance and Nominating Committee is responsible for, among other things: (1) recommending to the Board personsour chief executive officer to serve as membersa member of the Board and as membersour board of and chairpersons fordirectors.

Director Nomination Process

Director Qualifications

In evaluating director nominees, the committees of the Board, (2) considering the recommendation of candidates to serve as directors submitted from the stockholders of the Company, (3) assisting the Board in evaluating the Board’s and its committees’ performance, (4) advising the Board regarding the appropriate board leadership structure for the Company, (5) reviewing and making recommendations to the Board on corporate governance and (6) reviewing the size and composition of the Board and recommending to the Board any changes it deems advisable.

The Board seeks members from diverse professional backgrounds who combine a broad spectrum of relevant industry and strategic experience and expertise that, in concert, offer us and our stockholders diversity of opinion and insight in the areas most important to us and our corporate mission. The Corporate Governance and Nominating Committee has not set specific, minimum qualifications that must be met by director candidates. Rather, in determining candidates to recommend to the Board to serve as members of the Board, the Corporate Governance and Nominating Committeenominating committee will consider among other things whetherthe following factors:

reputation for personal and professional integrity, honesty and adherence to high ethical standards;

demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to the current and long-term objectives of our company and a candidate iswillingness and ability to contribute positively to the decision-making process of our company;

commitment to understand our company and its industry and to regularly attend and participate in meetings of our board of directors and its committees;

interest and ability to understand the sometimes conflicting interests of the highestvarious constituencies of our company, which include stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all stockholders;

ability to represent the interests of all stockholders without having, or appearing to have, a conflict of interest;

diversity of expertise and experience in substantive matters pertaining to our business relative to other board members; and

diversity of background and perspective, considered as a group, should provide a significant breadth of experience, knowledge and abilities that shall assist the board of directors in fulfilling its responsibilities.

The corporate governance and nominating committee’s goal is to assemble a board of directors that brings to the company a variety of perspectives and skills derived from high quality business and professional experience. Moreover, the corporate governance and nominating committee believes that the background and qualifications of the board of directors, considered as a group, should provide a significant mix of experience, knowledge and abilities that will allow the board of directors to fulfill its responsibilities. Nominees are not discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law.

We have no formal policy regarding board diversity, but our corporate governance guidelines provide that the value of diversity should be considered and that the background and qualifications of the members of our board of directors considered as a group should provide a significant breadth of experience, knowledge, and ability to assist our board of directors in fulfilling its responsibilities. Our priority in selection of board members is identification of members who will further the interests of our stockholders through their established records of professional accomplishment, the ability to contribute positively to the collaborative culture among our board members, knowledge of our business, understanding of the competitive landscape in which we operate and adherence to high ethical characterstandards. Our directors’ performance and sharesqualification criteria are reviewed periodically by the Company’s valuesgovernance and whethernominating committee.

Identification and Evaluation of Nominees for Directors

The corporate governance and nominating committee identifies nominees for director by first evaluating the candidate’s reputation, both personalcurrent members of our board of directors willing to continue in service. Current members with qualifications and skills that

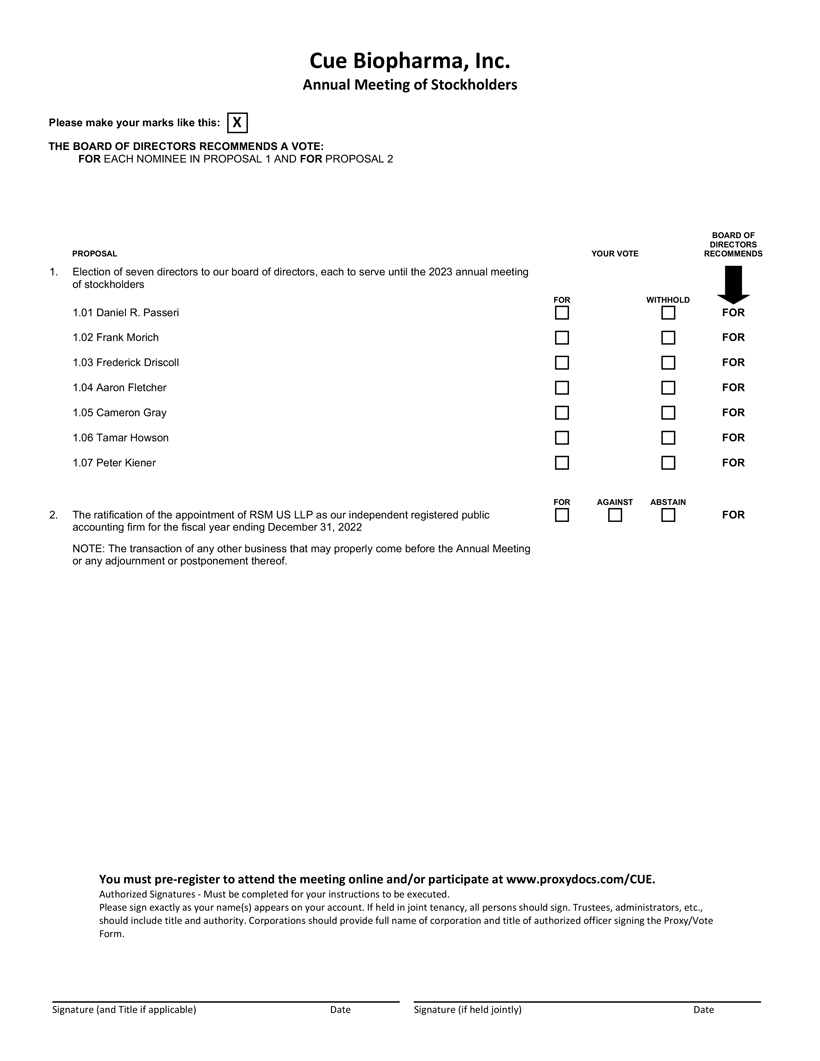

Please separate carefully at the perforation and return just this portion in the envelope provided.

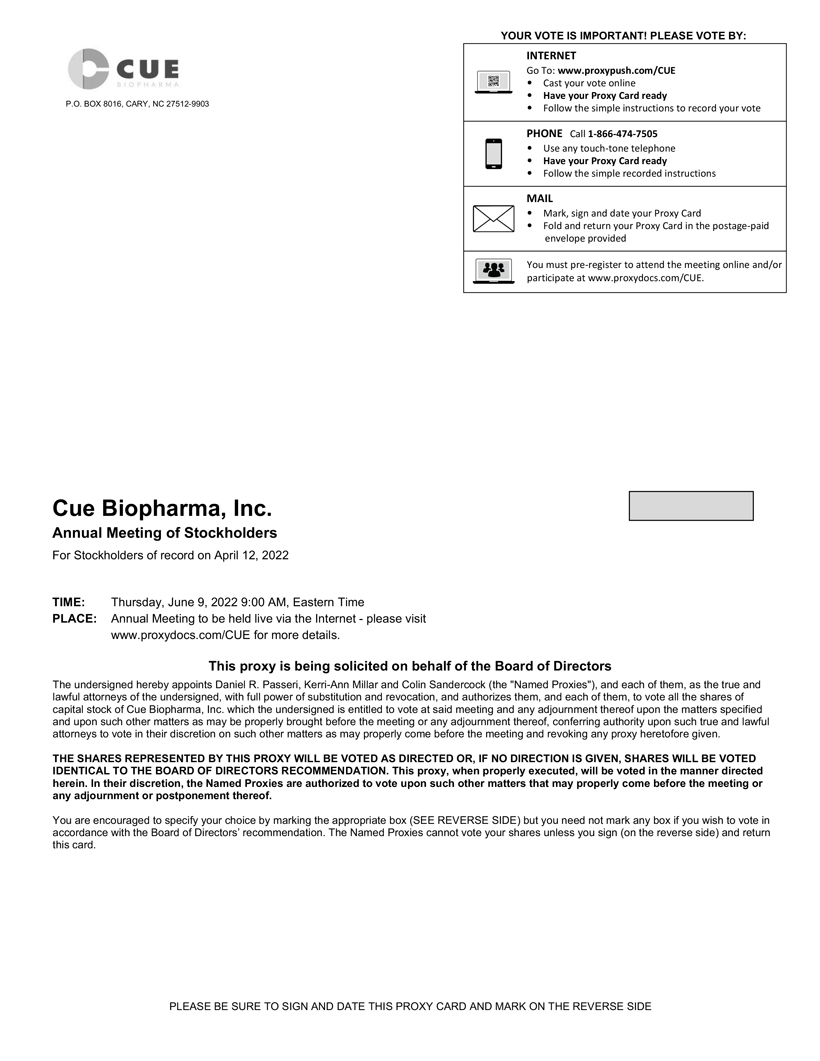

Please separate carefully at the perforation and return just this portion in the envelope provided.